Gambling Tax South Africa 2017

Economic recession in South Africa has helped to fuel a rise in the number of illegal gambling operators in the country.

- Gambling Tax South Africa 2017 2018

- Gambling Tax South Africa 2017 2018

- Income Tax South Africa

- Gambling Tax South Africa 2017 Demi

Although the casino industry succeeded in growing its gambling revenue by 3.5 percent in the year to March 2018, that increase was still below the level of consumer inflation, so in real terms it represents a continuing contraction, following a poor 2017, in which gambling revenue shrank by 1.8 percent; the first contraction since the industry was set up in 1997.

The NGB has pleasure in sharing the latest trends related to gambling sector performance and especially national gambling statistics and market conduct information as at the end of Financial Year (FY) 2017/18 (1 April 2017 to 31 March 2018). We trust that our stakeholders and the public will find the content informative, useful and beneficial. Despite online gambling being illegal in South Africa, a myriad of unlicensed operators offer their services in the country, seemingly with impunity. The Court subsequently handed down an unprecedented ruling in which R1.25 million in winnings were confiscated and forfeited to the State. The NGB has pleasure in sharing the latest trends related to gambling sector performance and especially national gambling statistics and market conduct information as at the end of Financial Year (FY) 2017/18 (1 April 2017 to 31 March 2018). We trust that our stakeholders and the public will find the content informative, useful and beneficial.

And while illegal gambling operations continue to operate in South Africa, the general uncertainty over the regulatory framework for the industry is also having a negative impact on legal casinos, which currently employ around 38,000 people nationwide.

Tougher stance

Speaking about the rise of illegal gambling operations, the Chief Executive of the Casino Association Of South Africa (CASA) said that law enforcement agencies needed to take a tougher stance to tackle the unauthorized gambling market, which he said were effectively stealing from the nation:

One of our biggest concerns is the exponential growth of illegal gambling operations. These illegal operators pay no tax or levies and contribute nothing to the South African economy.”

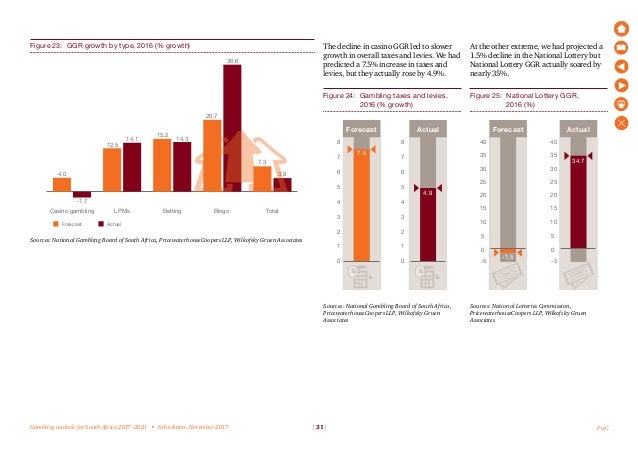

According to CASA, the industry will pay around 37 percent of its revenue; a total of R6.1 billion, in levies and taxes, at local and national level, during the current tax year. According to a recent report by Pricewaterhousecoopers, the South African gaming industry is likely to grow at more than 5 percent per year and could be worth R35 billion by 2021.

But CASA is warning that the government is denying the country substantial revenue by failing to crackdown on illegal operations, and through recently proposed changes to the casino industry, including a plan to introduce anti-smoking regulations in casino venues.

Andie Hughes is a UK-based freelance betting and gambling writer with over a decade of experience in the industry, having written for Betfair, ESPN, Boylesports, Sporting Life and various other popular betting sites. Contact Andie at andiehughes73@gmail.com.

NGB Goes Up Against Online Casinos &Cryptocurrency

In South Africa, online casinos are still causing the National Gambling Board headaches, and emerging crypto-currencies are just adding fuel to the fire says Caroline Kongwa. Kongwa is the NGB Accounting Authority, and she made this statement over the course of a two-day conference in Pretoria, Gauteng, over the 18th and 19th of July.

Winnings Confiscated

The issue hasseen the NGB and South African Police Service raiding illegal online casinos,with the Department of Trade and Industry confiscating R1.25 million worth ofwinnings in 2017. The board has revealed that illegal online activities areeroding revenue generated by the legal betting industry. It noted thatoperators are creating games that compete with what has traditionally beenoffered, and this has had a detrimental impact on formal betting.

Kongwa statedthat this impacts the government’s tax revenue ultimately, which then resultsin a loss of employment opportunities, a decrease in local economic activity,and consumer rights and protections being eroded.

Gambling Tax South Africa 2017 2018

International Operators are Problematic

Online gambling includes Poker games, traditional casino games like Roulette and Blackjack, and sports betting, and these options have been available since 1994. Although many countries restrict online betting or ban it altogether, it has been legalised in certain Canadian provinces, the majority of the European Union, and several Caribbean nations.

Kongwarevealed that online operators continue to offer their services in South Africadespite not being strictly legal. The only lawful route for South Africans isbetting through licensed bookmakers who have the proper permits to offerwagering on sports events and horse races. Citizens are not able to gamble withunlicensed international operators.

Gambling Tax South Africa 2017 2018

Serious Consequences for Law-Breakers

Presently,the gambling industry, except the National Lottery but including otherlotteries like society lotteries, promotional competitions and sports pools, isunder the regulation of the NGB. It is also subject to the 2004 NationalGambling Act. Kongwa said that, in light of online gambling being illegal inSouth Africa, operators face severe consequences if they’re caught offeringunlawful games, and gamblers could see their winnings being confiscatedentirely.

Kongwa went on to say the gamblers could also face prosecution for taking part in illegal activities. She went on to say that the Department of Trade and Industry took the National Gambling Amendment Bill to parliament in 2018, and this recommended no new forms of betting be allowed. It also included several improved provisions regarding legislation to deal properly with illegal gambling.

Income Tax South Africa

The proposedbill suggested provisions should be included which forbid illegal winnings,along with amendments to ban Internet service providers, banks, and otherpayment facilitators from smoothing the way for unlawful activities to occur.This bill would also cover the transferal, payment, and promotion of payment ofillegal winnings to South Africans.

Gambling Tax South Africa 2017 Demi

Thisprohibition will require extreme vigilance by the NGB in terms of alertingvarious institutions to illegal operations. If this notification fails to beimplemented, the affected body or institution will be criminally liable interms of the Act, and any winnings could be added to the Unlawful WinningsTrust.